The Internal Revenue Service (IRS) released a modified W-4 form for 2024. It’s not necessary to update your W-4 each year, but understanding what’s changed will help you stay informed and make wise decisions about your tax withholdings. We’re walking through the changes you can expect and guiding you on filling out your W-4 for 2024.

What is a W-4?

A W-4 is an IRS tax document that employees fill out and submit to their employers. Employers use the information provided to calculate how much tax to withhold from the employee’s paycheck.

What’s changed?

Here are some of the key changes to the W-4 for this year:

- Elimination of allowances – You will now need to enter more specific information about income and deductions.

- Additional withholding options – Additional options for taxpayers such as for multiple jobs or non-wage income.

- Tax withholding estimator – The IRS has developed a new online tax withholding estimator that can be used to help complete the form.

How do I fill out my W-4?

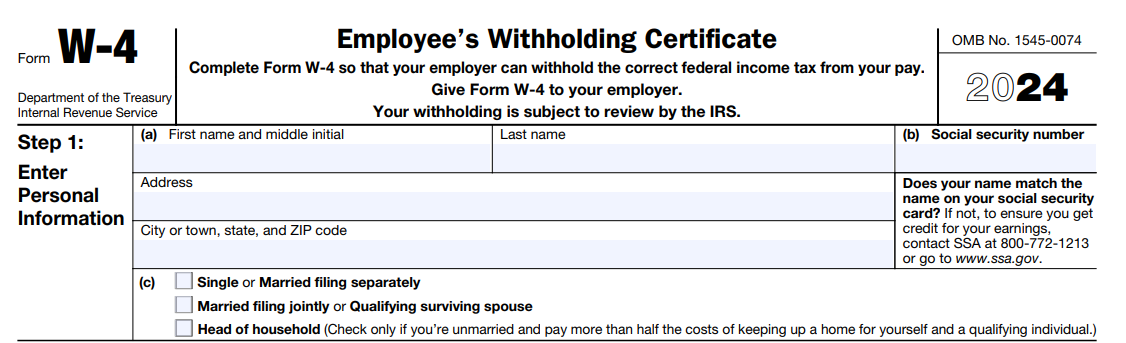

Section 1: Enter your personal information. Determine your tax filing status through the IRS website.

.png)

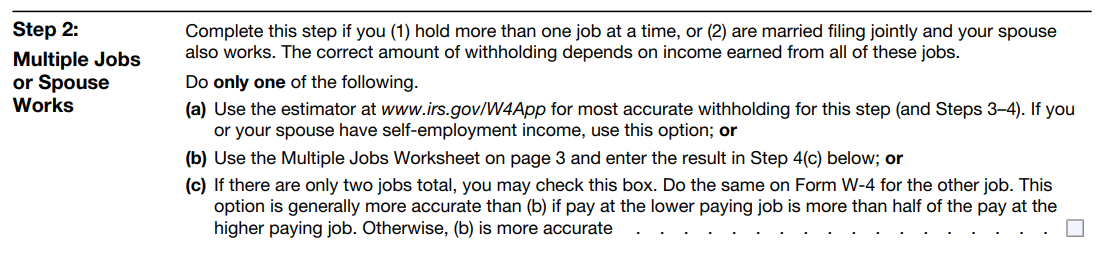

Section 2: This section will only apply to you if you (1) have more than one job or (2) if you file jointly and your spouse also works. Use the IRS tax estimator (most accurate) or the Multiple Jobs Worksheet to determine how much tax should be withheld. Alternatively, if you (or you and your spouse) only have two jobs total and make roughly the same at both, you can check the box for option 2(c). For this option, you must check the box on the W-4 form for both jobs.

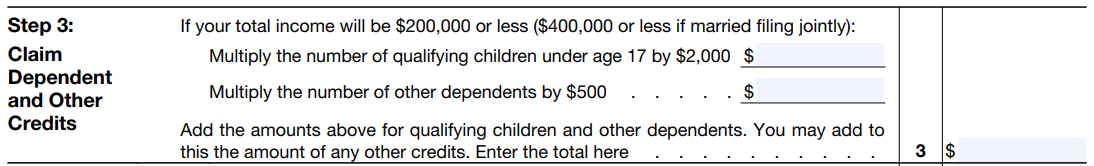

Section 3: Claim your dependents. If your total income is under $200,000 (or $400,000 if filing jointly), you can enter how many kids and dependents you have and multiply them by the credit amount. You can also choose to not claim dependents — even if you have them — if you need more taxes taken out of your paycheck to reduce your tax bill.

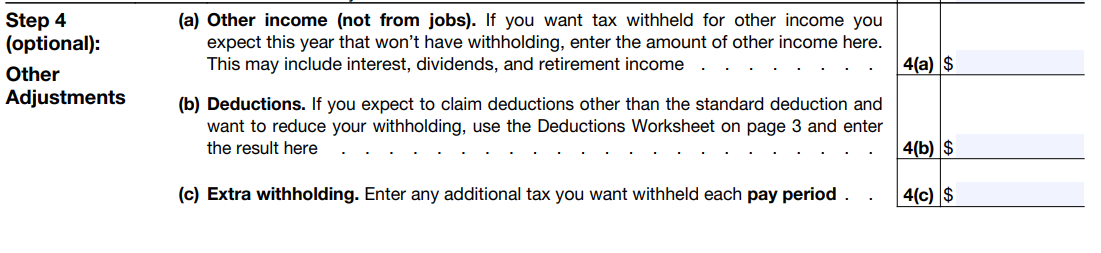

Section 4: This section is if you want extra tax withheld or expect to claim deductions other than the standard deduction when you do your taxes.

Standard deductions for filing 2023 taxes in 2024:

- For married couples filing jointly: $29,2027

- For single taxpayers and married individuals filing separately: $13,850

- Heads of households: $20,800

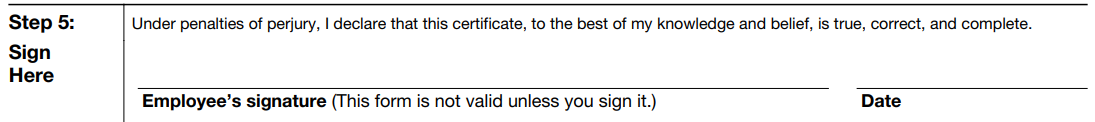

Section 5: Enter your personal information. Determine your tax filing status through the IRS website.

Ready to file your 2023 taxes?